P2P lending in India - Invest to grow your savings

- Sanyam Jain

- Jan 26, 2019

- 3 min read

"Invest in peer to peer lending in India. Earn up to 35 per cent returns." You might have come across the claim at least once or twice during the last year. Did you wonder: Really, can one actually earn double-digit returns by lending money online? In this article, we try to explain- all about P2P lending and can you actually earn these fancy returns.

Peer to peer lending is not an entirely new concept. People used to lend/borrow from their friends and family member long before the advent of traditional banks. P2P lending extends that by creating an open market place which brings borrowers and lenders together on a common platform. This is similar to cab aggregators Ola and Uber which brings drivers and riders at their platform without owning a single cab of their own.

Though P2P doesn’t just serve as a platform, it goes beyond. To make the lending and borrowing effective and smooth, they screen the borrowers for credit checks, physical verification, ITRs and various other factors to ensure quality. They also take care of all the legal work and help with recovery in case of defaults and delay in EMI payments.

Do we really need it?

Lot of borrowers are not able to get loans from traditional banks due to factors like low or no credit history, less or inconsistent income especially unorganised sector or cash driven businesses, where Income tax return does not reflects the true earning, hence limiting the borrowing capability.

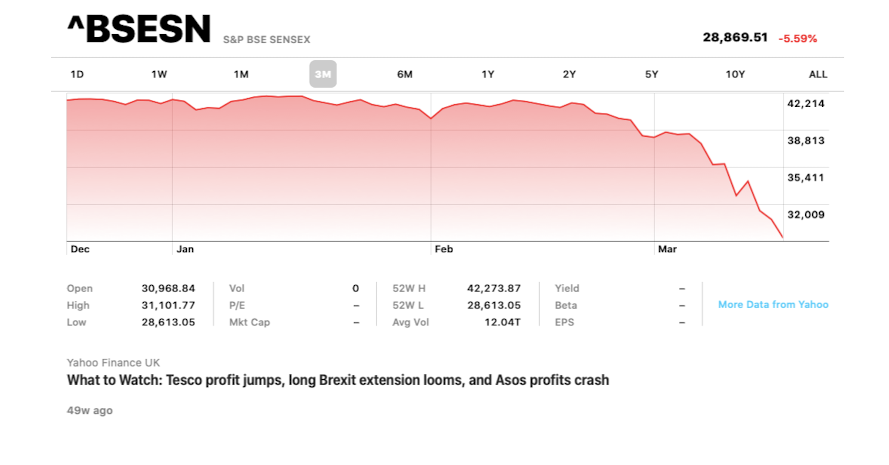

On the other hand, the lenders don’t have many options where they can get fixed double digit returns without worrying about stock market movements.

So, It’s a win win situation for both the borrowers and the lenders.

Other advantage is that being tech-driven, the P2P lending eliminates the long delivery processes by leveraging analytics and automation to onboard borrowers and lenders online and facilitates credit in real time.

In Oct 2017, The RBI devised a regulatory framework and categorised the P2P lending companies, as NBFC-P2Ps, giving a much-needed push to the relatively new and still evolving sector.

Few things to keep in mind:

For borrowers they could just look for the cheapest product across all platforms, but lenders need to be careful as their money is at stake here.

The key thing while lending through these platforms is diversification. Each platform divide the borrowers in different risk buckets(high/low risk etc), based on their profile. Diversification should ensure that the investments are not skewed towards certain category of borrowers.

Invest small and try to spread the investments across 50-100 borrowers over the time. This would safeguard your returns from plummeting in case of a few defaults which is inevitable in lending business.

Don’t just go after high returns. High returns comes at the cost of high risk.

Depending on the risk appetite of a person, P2P investments could be another asset class in the overall investment portfolio alongwith: FDs, Mutual Funds, Gold, Real Estate etc

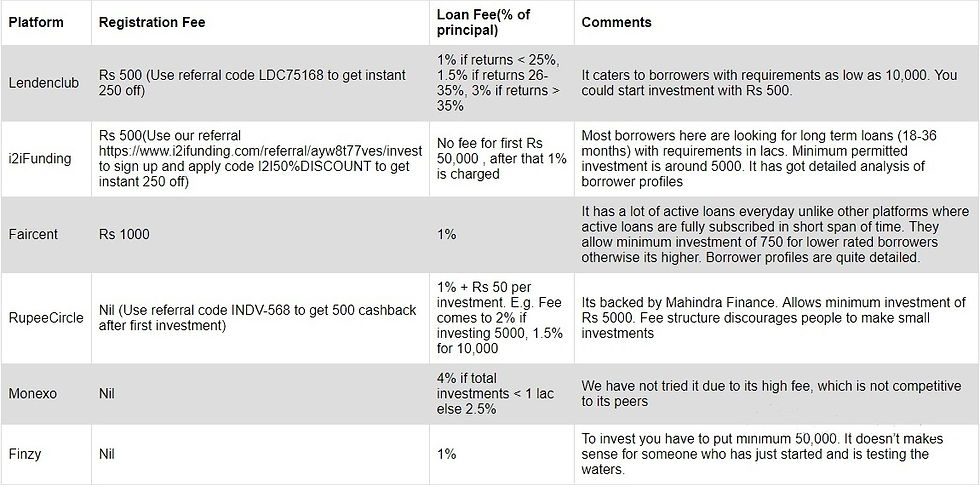

There are many P2P platforms currently available in the market, we’ll discuss few of the noteworthy over here:

Note: We will request you to use these referral codes to open the account as it’s a win-win for both the person who refers and person who signs up using the referral code. In this way, it also helps us keeps us running.

Current status of P2P lending in India:

Most of the platforms have a high minimum investment e.g. On some platforms, lender has to commit minimum 5000 for a loan of 50,000, which means 10 people are taking the risk if this borrower defaults.

Ideally, lenders should able to commit as low as 1 % of the requirement, which will spread the risk across 100 lenders. This would boost P2P lending, as impact of defaults would be significantly low or negligible.

P2P lending in India still needs some iteration of regulations to shape up in a mature investment avenue.

Our Recommendation:

Based on personal experience of using LendenClub, RupeeCircle, I2IFunding and Faircent, I would recommend people to start with RupeeCircle initially. There is no registration fee and easy to spot decent active loans.

Next choice would be I2IFunding, here the quality of loans look good, but there are a lot of active investors. As a result, loan gets funded within minutes of getting listed, so one has to be really proactive.

We encourage you to share your thoughts and experiences in the comments below, to help us and the fellow readers.

Do let us know on which topic you would like us to write our next article, you can also shoot a mail to help@niveshgyaan.in

Disclaimer : This is just author's personal views and does not include an exhaustive list of all p2p lenders. People should do their own research before investing.

Reference : https://inc42.com/resources/how-rbi-is-solving-p2p-lending-issues-and-indias-credit-woes/

Comments