How am I investing in times of Coronavirus?

- Prashant Agarwal

- Mar 19, 2020

- 5 min read

20 Minutes

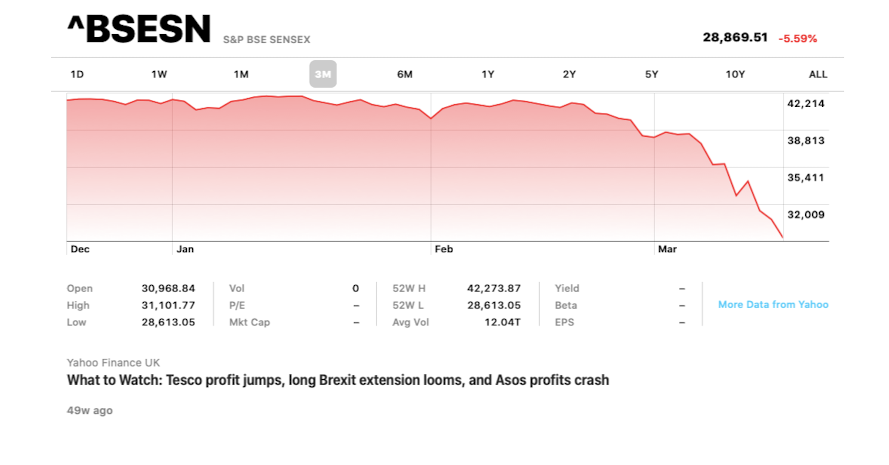

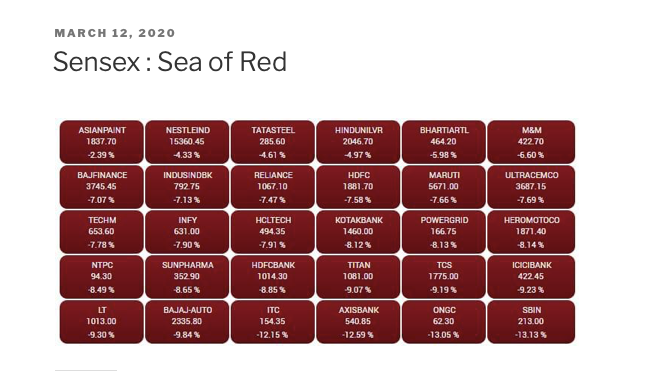

Three of the biggest falls in the history of Indian stock Market happened in the last one month i.e. Feb,2020- 18th March ,2020. It’s Obvious that you will lose any conviction you have in stock market or the rationality of the stock Market.

Moreover, when you think of investing and find out that all the biggest companies in Indian economy are falling – It will surely shake you up.

Though what could we do? Honestly, I don’t know, however, I can let you know what I have been doing.

Stop listening to the news:

More I hear the news or the TV anchors; the more I get paranoid about the future and my portfolio.

While there is definitely good news as well i.e. Volatility is your friend. Stick to the long term. Don’t touch your portfolio. Keep some cash. Invest that in a staggered manner. Recheck your asset allocation. Shuffle your stock portfolio. Don’t borrow to invest.

However, fear sticks quickly and longer with us, therefore, there is a huge chance that you will panic because all said and done, the market is in bad shape and most of our portfolio would be in red..

My advice: I am following Twitter more than any news channel as twitter gives me an option to follow people whom I believe is giving a sensible advice and also unfollow those whose only aim is to spread negativity.

Moreover, I am trying to restrict myself on twitter also only twice or thrice in a day for 15 mins.

And I remember this Quote from Warren Buffett i.e. Future is never clear and if you find some journalist or a speaker trying to predict future then definitely need to stop following them.

On my Portfolio:

This one is a tough question and I have tried 3-4 strategies in the last one month and while telling you about the strategies and the mistakes I have committed, I will also let you know what I feel it’s the right strategy to follow in the times of Corona.

Overall Strategy:

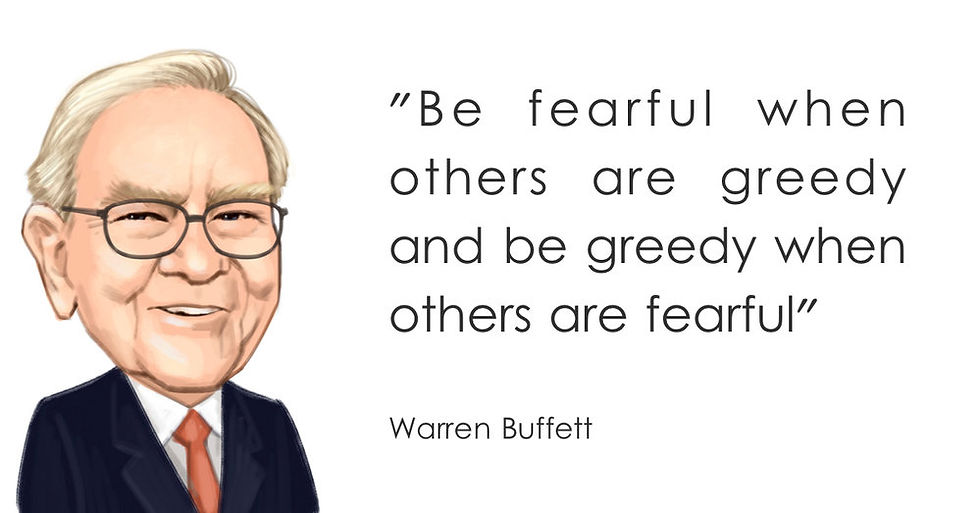

Firstly, I am definitely following the saying of Warren Buffett “ Be fearful when others are greedy

and be greedy when others are fearful” and right now the market is looking too much fearful therefore I am getting greedy to buy stocks.

This also means that I have taken a cognizance of my losses and I am not getting disturbed to sell them in a panic mode though I have to admit that I am not able to build an appetite to invest 100% of my cash reserve in the stock market at this point of time.

So what I have done.

Starting from a Clean Slate:

I have listed down all the stocks which I own or were in my watchlist and determined the price which I feel it’s a justified price of that stock.

On 6th March,2020: I felt that market had fallen quite a lot, thus, bringing a lot of stocks in my price range and I went in with a lot of gumption and invested around 10% of my current portfolio.

This mistake cost me dearly as that was just the start of the fall of stock market and all the stocks will get discounted by another 10-15% in the coming days.

Learning from my mistake: While I was sure that with the next bull run, I would recover my money yet I now know that few of those stocks where I invested, would not be the 1st one to start the uptick movement.

I again looked at my sheet and this time set an unreasonable price for all my stocks and I decided that I would only buy if the stocks reach those levels.

Moreover, I created a priority list i.e. which are the stocks where I have got the maximum conviction and prioritized all my stocks.

Moved away from averaging: Averaging looks so enticing yet I decided that I am only going to invest in the top 15 stocks based on my priority list.

Few of my good stocks were left out of this list, yet I was knowing that while they are great stock, though my aim is to find the stocks which are of a very high quality and will rebound the fastest during the next bull run.

Invest time in your stocks:

Finding the price of a stock is one thing though able to understand it’s fundamentals and having a conviction is all together a different ball game

Therefore, I have created a list of stocks in my portfolio which have not been performing and these days I am trying to understand that whether it’s a temporary phenomenon or there is something really wrong in these stocks.

I am sure I would have made some mistakes in my investing though I am ok with that, as Peter Lynch says “ In this business, you Don’t need to be correct 9 out of 10 times though would be happy to be correct only 6 out of 10 times and learn from each mistake”

Segregating my Portfolio:

Moreover, I have tried to segregate my portfolio into three Segments:

1st- Segment - Short term bets: These are the stocks which I have bought due to huge value mismatch or because of some news, however, I haven’t done full justice on the research on these stocks.

For example, Recently Tata Sons have brought stocks in few of their companies which reinforced to me that there is value in these stocks, and I bought some of these.

However, I will start my research on the same and if I find value then I would move these to the 2nd or 3rd segment or exit the stocks in Segment 1, within a year.

2nd Segment: Medium Term Bets: These are the stocks which I will retains in my portfolio for 1-3 years i.e. I have done basic research on these stocks and while I have conviction, yet they haven’t delivered huge returns and I would like to wait for a few quarters before moving them to either Segment 1 or Segment 3.

3rd Segment: Long term bet: These are those stocks where I have high conviction (Moreover these are those stocks where we should be investing in the current situation). I am happy to hold these stocks for the next 5 to 7 years as I believe they have got good fundamentals and have given good returns to me in the past.

I myself don’t know how my strategy will span out as I have not seen such a carnage in stock market before though I am an eternal optimist and I do believe that “Future has always been better than the past and for the world has always peaked faster than every fall then be it 9/11 or a world war”

Coming to your portfolio:

Ask this question for each stock you own – “If I did not own this stock already, and of what I know now about this business, management quality, competitive advantage, staying power, long term growth, and current valuation, would I buy it for the first time today?

If the answer is yes, keep the stock. Period.

If the answer is no, sell the stock. Period.

Ask this question for these new stocks – “Of what I know now about this business, management quality, competitive advantage, staying power, long term growth, and current valuation, would I buy this new stock for the first time today?

If the answer is yes, buy the stock. Period.

At the end just remember- Stock price is just a number though a company is a real entity and while stock price is a reflection of the performance of a company though most of the times stock price act irrationally and we as investors have a job to segregate the price from the performance.

Comments