Misconceptions about the Mutual Funds

- Prashant Agarwal

- Jun 3, 2018

- 3 min read

I was having a conversation with one of my ex-boss about Mutual Funds and as she had subscribed to regular funds through an agent, I suggested her to opt for direct funds.

However, her argument was that ‘She likes the convenience and if the MF’s are able to provide her better returns than she doesn’t have any issue with paying the commission to the agent’.

While I don’t think I did a good job in convincing her at that time though I realized that it’s the same thinking which a lot of people share about their agents and they do have some misconceptions around the same.

Therefore, I thought to pen down my thoughts pertaining why do I feel that we need to move to Direct funds as the benefit is huge for the end customer and with a lot of companies jumping in the domain including the “Mutual Fund Association of India” the hassles have reduced drastically.

Let’s start with the basics:

Direct plans of Mutual Fund schemes give higher returns than regular plans because of the lower expense ratio. The lower expense ratio is due to the fact that Direct Plans do not pay any commissions to the advisor (usually an RIA). The commission savings means that for the same scheme, the Direct plan can have up to 1.5% / year higher returns than Regular plans.

Direct plans were mandated by Securities and Exchange Board of India (SEBI) in 2012 and implemented from January 2013. It has been 4 years and there are quite a few fees only advisors (both online and offline) in the market. Nivesh Gyaan is one of those platforms which is completely an upfront fee-based system with no hidden charges accrued to the customer on year on year basis.

Myths that still persist about Mutual Fund commissions.

Commissions are small –

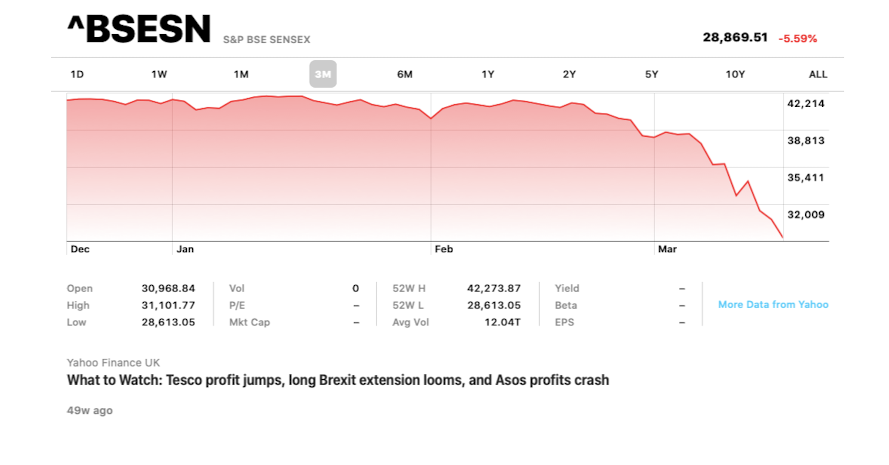

Brokers always characterizing Mutual Fund commissions as small. Infact, 1.5% annual commissions do look small – but its long-term impact on your portfolio is very big. While brokers will be the first to highlight the compounding effect of long-term Mutual Fund holdings they fail to highlight that commissions paid out annually also have a similar compounding effect. Saving 1.5% in commissions every year would mean a 45% larger portfolio in 25 years or a saving of 28 lakhs on a SIP of 5000/- for 25 years.

Commissions are one-time fees –

A lot of investors feel that the commissions are paid only once during the ‘Buying of the policy’ during the 1st year. However, in reality, if you buy a policy from a broker, they will continue to receive annual commissions as long as you are invested in that fund. Commissions are buy once, pay forever until you sell/discontinue your policy.

Commissions are paid only when I make the profit –

A lot of people ask this question, thinking that the agents get the commission on their profits, however, the truth is that they get the commission on the invested amount, even if the Mutual Fund make loses. Therefore, irrespective of you making a profit or a loss they will get their premium, which would mean if you have an MF with an annual holdings of 10,00,000 than your agent is getting around 10,000 out of it every year.

But they are offering their service for free:

A lot of people believe that as they are offering their service for free, it’s ok if they charge them some commission which is small. I hope you would have understood that the commission are not small. Moreover, if you do go with a fee-based agent he will charge you a one time fee which in most cases is much less than the commission of your agent in the 1st year itself and no charges thereafter.

Commissions cannot be avoided –

Because it has been a practice from the last 15-20 years until recently, a lot of investors end up believing that commissions are something you have to pay in Mutual Funds. This is far from the truth.

Online Direct plan advisors like ours will help you invest in the Direct plan of Mutual funds and help you save commissions. Remember an online “Free for life” account to invest in Regular funds is actually a very expensive way to invest in Mutual Funds

Note: Mutual Fund commissions were necessary till 2013 as there was no way to invest in Mutual Funds without paying commission. Not anymore with Direct Mutual Funds Investment plans.

I hope next time when someone tells me that they prefer Regular Mutual Fund, I would be better prepared to convince them that why Direct Mutual Funds are better.

Reference:

Zerodha Coin

Kuvera

Comments