Why do I need a Financial Plan?

- Prashant Agarwal

- Apr 30, 2018

- 3 min read

Recently, one of my friend who just started working came to me to take help of the investments. He wanted to invest his money in mutual funds and stocks. On hearing his ideas, I got impressed that he has already started thinking along the right lines.

However, as a habit – I asked him whether he has got a Life insurance and a health policy, and he said that’s the department which his parents look into and he doesn’t have any clue about it.

Therefore, I asked him to first get a financial plan for himself than investing his money into stocks or Mutual funds. I think he thought I am trying to sell him my services and don’t want to answer his investment question. Thus, he went home bit dejected without giving me proper time to explain the rationale for my reasoning.

Firstly, irrespective of how much time you spend on your personal finances, or how much you earn or spend or save, you should have a financial plan as soon as you get independent and start earning. Or at-least when you start a family.

A financial plan is not just another idea or scheme however it’s like the financial roadmap for your freedom. Moreover, I want to clear the conception that financial plan is mostly about the life and health insurance. It covers a lot more than that including your Goal planning, your investments, your current debts and liabilities, emergency fund and tax planning.

I have seen people worrying too much about the small things, while not giving adequate attention to the long-term goals. I remember discussing with a colleague who keeps tracking each and every penny that he spends on whatever he does. I don't say it's completely waste, but does it really have an ROI?

I would rather suggest worrying about bigger things like

How much money do you need to retire?

When do you want to retire?

What are your recurring goals?

Do you need a term insurance?

Does your family need a health cover?

What are the key skills you have and how you can leverage them?

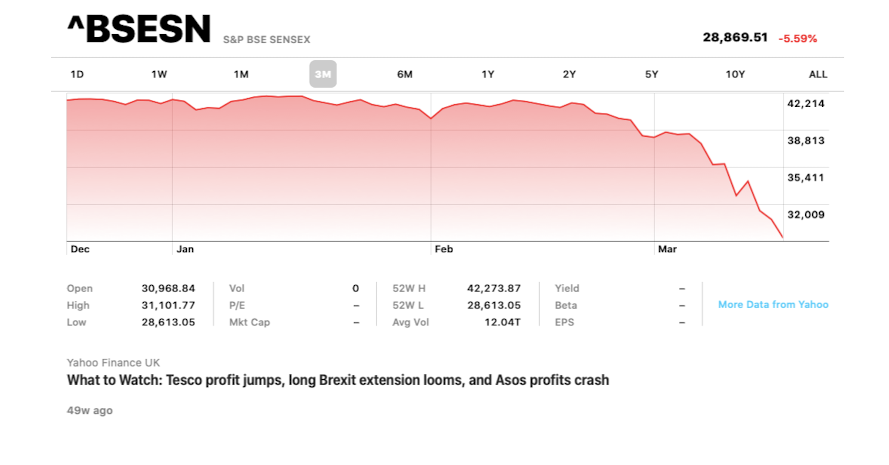

Smaller financial things in life would automatically fall into place if you have taken care of the bigger items. If you don't do it already, start thinking now about the buckets of investment. Allocate a specific amount to your monthly expense bucket and use whatever it must do whatever you want. Rest all goes towards building a corpus for your goals. There are always two ways you can approach your investments

Income - expense = savings

Income - savings = expense

And second is the approach you should be following. If you really want to meet your goals and want to measure them, I would suggest you start with following a simple exercise

Make some assumptions about the following - your date of retirement, the amount you want to retire with, the rate of inflation, %age return on your savings. etc.

Start with your Net worth

And then the cash flow statement

Determine your goals, how much you need by when for what?

And start measuring, do you save and invest enough to take you there?

The numbers might give you a bit of pain in terms of how much you would require during your retirement. however, I feel it’s better to understand the pain rather than experience it.I hope this article will convince my friend that investing is important however a more important thing to understand is our goals and whether our investments aligns with our goals or not.

Next Article:

I would be writing next on the difference between the Investment advisors, MF’s and Insurance agents. Also, why there are a lot of people who are ready to make your financial plan for free.

Reference:

Fiscalmatter.blogspot.in

Comments