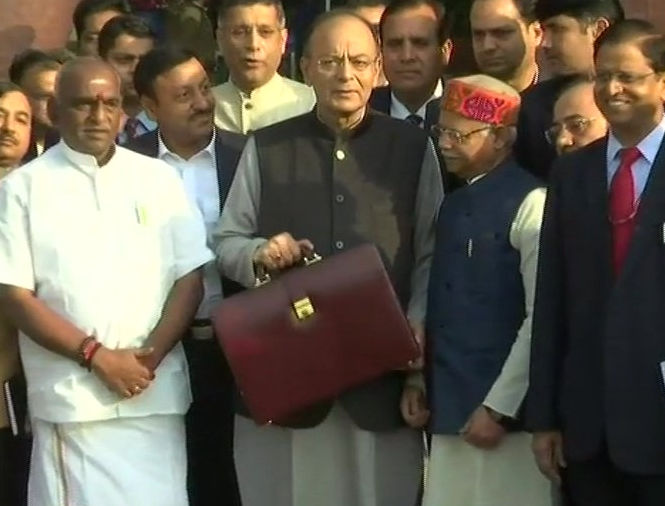

Why I am disappointed by 2018-2019 Budget

- Prashant Agarwal

- Feb 1, 2018

- 3 min read

All budget are political in a sense though this budget there was also a sense of urgency with the assembly elections this year and the general elections next year and therefore it would also be the last budget for this government. Therefore there was a lot of emphasis on new schemes and policies and I can definitely say it was one of the budget which tried to touch every aspect of the economy.

While I am disappointed, though still let me start with my Aha Moments from this budget which definitely were the MSP for the farmers which would be now the 1.5 times the cost of production and also the Health coverage for 500 million people up to Rs 5 lakhs.

However, My ‘Aha Moment’ also gets flattened when I look at the past performance of this government as Mr. Arun Jaitley announced during the budget that ‘that this government has been paying 1.5 times the cost prices of Rabi crops and would do the same now for Kharif however according to a government website, Food Corporation of India, the cost of production is around 2345, yet, the government just paid Rs 1525 in 2016-2017 and 1625 in 2017- 2018.

Looking at the other Aha Moment of Health Insurance it do reminds me of the other great promises from this government from ‘Swaach Bharat Mission’ to ‘Make in India’, So, what I feel is that Implementation would be the key if we this government is really serious about insuring 500 million people.

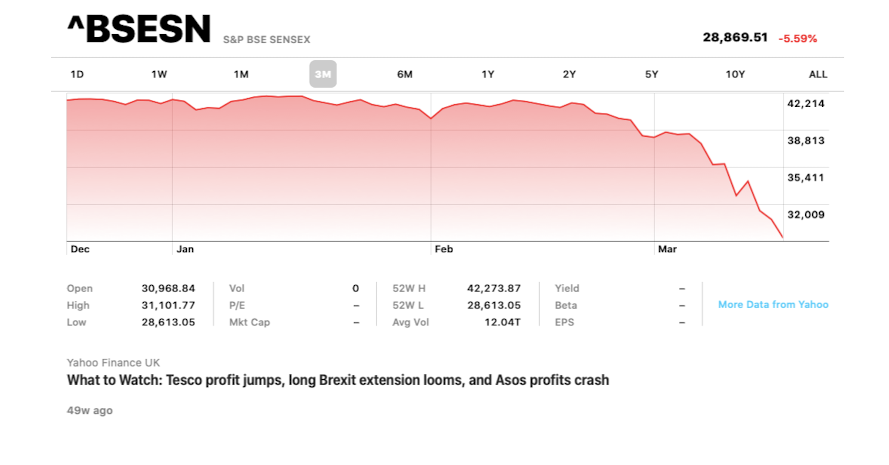

Another big issue which was slided under the carpet was the Impact of Demonetization and GST, while both these policies were implemented stating that we would be able to garnish more revenues from the corporates and pass on to the salaried and common people though from the economic data and this year budget, it looks like that nothing of that sort is happening for now as the Fiscal Deficit was supposed to be 3% for 2017-2018 however it has been increased to 3.5% and for next year as well it has been increased from 3% to 3.3%, which clearly means that this government created a false sense of over optimism on GST and demonetization which is not visible for now.

But, the question is where it all leads to and how would this government is going to implement all these big schemes? And the answer which seems to come out of this budget is tax the salaried people and which my biggest ‘Oh Moment’.

Confuse the middleman: The 2nd biggest sham of this budget was the ‘Re-Introduction of standard Deduction’ which is a good move though the moment you remove the existing annual transport allowance of Rs 19,200 and Rs 15000 medical reimbursement. The net benefit which is left with the people is just Rs 5800 only.

Moreover, it would also depend upon your tax bracket. The saving in tax would be Rs 290 for those currently paying 5% tax on this income; Rs 1160 for those paying 20% tax on this income; and Rs 1740 for those paying 30% tax on this income.

However, these savings would be nullified in most cases, except in the case of income up to Rs 5 lakh, due to increase in the cess payable from current 3% to 4% on the rest of the income tax payable by the individual. As a consequence, individuals with income above Rs 5 lakh would end up shelling out more tax after taking into account the standard deduction, the removal of the allowances and the increase in cess.

So why to introduce Standard Deduction then?

No Change in Income Tax Slabs:

We all have been given a promise of ‘Acche Din’ and It was much desired to increase the tax slab of 5% from current 5 lakh to 10 lakh. However Mr. Finance Minister thought to leave the tax slabs as the last year and therefore, there is no change in the tax slabs as well.

Reintroduction of LTCG:

It was expected to be reintroduced, however, the market believed it would either come with the removal of SST(Securities Service tax) or they will change the definition of long term from one year to either two year or three year.

Yet, FM, introduced the LTCG of 10% of any again above 1 lakh which will impediment the entry of lots of new investors, as now their returns would also need to stipulate the 10% tax before calculating their returns.

At the end, while I will wait for the details to come out but from the outlines it looks like a budget which feels like ‘Middle class as its main source of income’ and have decided to take the maximum leverage from the same.

I will end my complaints with this budget with something I read on twitter today.

Since birth I have seen two types of budget!! 1. Bad Budget and nothing for middle class! 2. Good Budget but nothing for middle class!#Budget2018 Courtesy @pokershash

Comments