One investment which Warren Buffett Endorses-Index Fund.

- Prashant Agarwal

- Jan 22, 2018

- 4 min read

What is Index Funds:

Index fund as the name suggests follows a particular index. for eg, HDFC index fund copies Sensex that means the fund would buy all the 30 stocks that are in Sensex in the same proportion.

In other words, if Infosys has 10% weightage in the Sensex, an index fund tracking the Sensex will also hold Infosys as 10% of its portfolio.

One more example of index funds is: UTI Nifty index fund which copies nifty 50

They move in the same direction as the index does as the funds are in the same proportion.

Some of the advantages of Index funds:

It has low expense ratio that ranges from 0.2% to 1%

There is no issue of bond stock selection or fund manager dependency

Easy to understand and select a fund

Investing in index funds, you have got 3 choices. One, you'll be able to invest in a very fund that tracks the Sensex and second, a fund that tracks the nifty. The Nifty has fifty corporations in its index compared to Sensex that has thirty corporations. All these corporations are arranged according to their Market Capitalization; therefore, you will surely find the 30 companies in Sensex being included in Nifty.

Thirdly, you'll be able to invest in associate degree index and fund. These funds invest the majority of their assets into a selected index and the remainder of the assets are managed actively.

How are they different from a normal Mutual Funds?

They are quite similar to Mutual funds and vary only only on one count:

No Active Manager: As Index Funds invests in a basket of predefined stocks of an Index, therefore there is no active manager and thus the fund charges are also low in comparison to Mutual Funds.

How they got popular:

Warren Buffett and Benjamin Graham have recommended index funds as one of the best investments for small investors who don’t have the capacity to pick their own quality stocks or mutual funds.

This is exactly what index funds proponents have been using as their rationale to sell such funds in India for long.

However, the thing is that it may make sense for American investors to invest in index funds simply because the index funds there are far more indicative of the broader market (as they track indices that contain 500 to 5,000 companies).

In India, you have just two indices available – the 30 share BSE-Sensex and the 50 share NSE-Nifty. Such a small number of companies are anyways not indicative of the broader Indian market.

Why haven’t they got popular in India:

According to AMFI data, the ETFs in India (excluding gold funds) manage just 3 percent of the total assets in the fund industry.

Wrong indices:

Finally, faithfully mimicking an index makes sense only if the basket of companies that make up the index has good fundamental prospects and are potential long-term wealth creators. But most of the available index products in India don't put much science into the index they track. They end up passively mirroring the market bellwethers such as the Sensex or the Nifty. In our analysis, 37 of the 67 index funds in operation piggybacked the Nifty or the Sensex, with a majority of the others tracking readymade sector indices. However, Sensex and Nifty baskets comprise the most active and liquid names in the market. These are not necessarily the best fundamental bets.

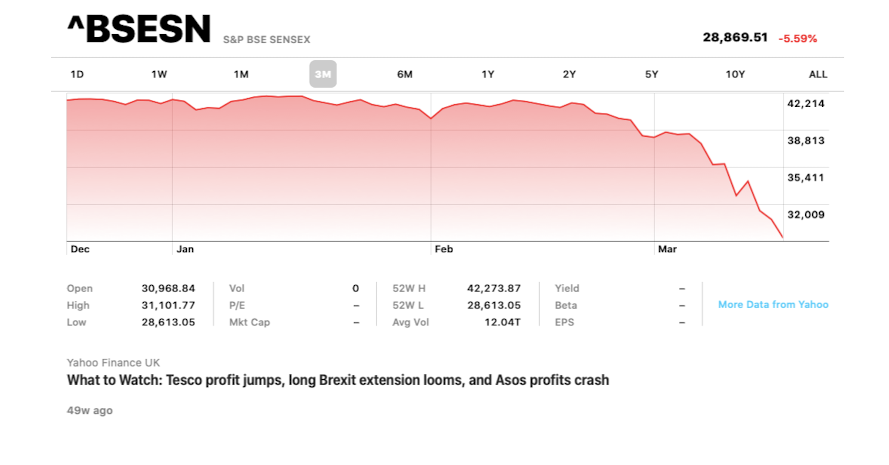

Tracking error: Index funds and ETFs in India show quite a significant deviation from their benchmarks. A Value Research analysis of 67 (non-gold) index funds and ETFs showed that on one-year returns, 45 per cent of the schemes showed a 1 per cent or higher annual deviation from their benchmark returns. On a three-year basis, 30 per cent of the schemes generated returns that were 1 per cent or more off from their chosen benchmarks. On a five-year basis, 25 per cent of the funds showed a 1 per cent return differential. Over a ten-year period, 19 per cent of the funds registered this deviation. This analysis is based on data as of April 19, 2017.

Not cheap:

A second argument for passive investing in the global context is that index funds charge a fraction of the costs that active managers do. In India, this doesn't hold true for most index funds.

True, with the emergence of more index products, you now have a few ETFs that charge less than 0.10 per cent of the NAV as annual expenses. But then, there are a good number of index funds that charge you more than 1 per cent, too. Value Research analysis showed that 12 of those 67 index schemes had an annual expense ratio of over 1 per cent as per their latest factsheet disclosure.

How to Invest in Index Funds:

They are liquid in nature and provide you with the flexibility to invest not only in a lump sum but in small installments as well in form of SIPs. It is easy to buy with an only requirement of KYC to be in place. KYC can be done with the help of Pan card. It usually deducts the 50-120 bps as fund management costs.

Therefore, you just need to go to their website and provide them with your Pan-Card and invest while sitting at your home itself.

Our final verdict:

Maybe indexing in India will undergo transformation only if global indexing specialists, like Vanguard, enter the Indian market. After all, for AMCs, which manage a large portfolio of active funds, along with a few ETFs/index funds, there's little incentive to promote the latter.

However, they still have few advantages to their sleeves and yes, they are less volatile and if someone is planning to bet on Indian story for a long run then Index Funds can be a good bit.

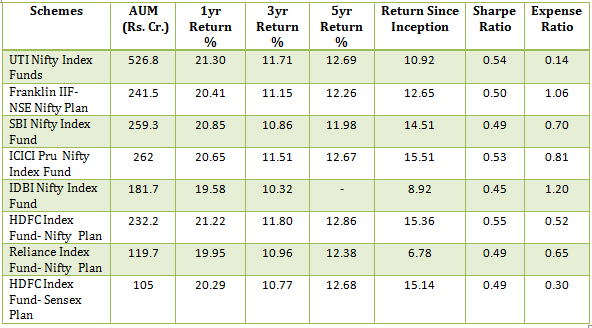

Few good Index Funds In India:

UTI Nifty Index Fund

Franklin India Index Fund -NSE Nifty Plan

SBI Nifty Index Fund

ICICI Pru Nifty Index Fund

IDBI Nifty Index Fund

HDFC Index Fund- Nifty Plan

Reliance Index Fund – Nifty Plan

HDFC Index Fund – Sensex plan

The data in this table is of 11th April 2017

Reference for this article:

Quora

Value Research Online

Safal Niveshak Blog

Bodhik Blog

Comments