Housing Theme: Everyone is riding this high tide for now

- Prashant Agarwal

- Nov 30, 2017

- 2 min read

Time: 15-20 Minutes

HDFC Mutual Fund has come out with the HDFC Housing Opportunities Fund(HOF) focused on the theme of housing and the opportunities it offers in sectors such as paints, cement, electrical, etc. Therefore, as you can see this fund is not only about HFC (Housing Finance companies) alone but provides a much broader theme. This fund is a mix of equity and debt with about 10-20% debt (corporate debts or corporate papers).

HOF is a 3-year closed-end thematic equity fund. The fund is particularly keen to capitalize on the low-cost housing sector, which is a key focal point of the central government, which has taken steps to encourage low-cost housing. The fund closes for subscription on 30 November 2017.

The good thing to note over here is that HDFC Asset Management Co. Ltd draws from the experience of its group company Housing Development Finance Corp. Ltd, which has been in the housing loan segment over 35 years.

However, there are few things which should be kept in mind before investing in this thematic fund.

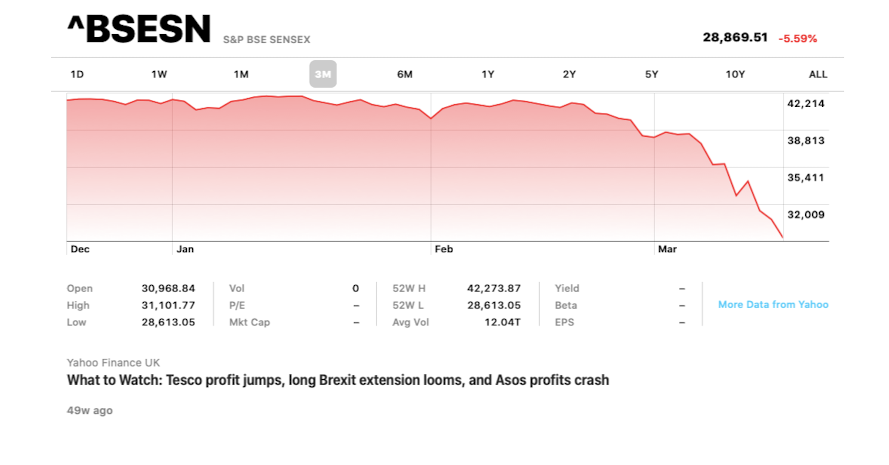

Thematic funds are considered to be the riskiest types of MF Schemes because of their nature i.e. If the affordable housing segment—goes through a slump (the housing sector is anyway going through one such slowdown at the moment), HOF1 would go through a slump as well.

HOF is a closed-end fund. Premature exits would only be allowed on the stock exchanges at the prevailing market price, which—like many closed-end funds—could trade at a significant discount to its prevailing net asset value.

Most of the sectors associated with housing finance have already rallied quite a bit in the past few years and are currently trading at close to their 52W high, so it would be a mammoth task for the management to find ‘Hidden stars’ in the market.

While it has a 3-year lock-in period though there is no tax benefit on investing in this scheme.

Our stand:

We advise against investing in thematic funds and closed-end funds unless you are sure about that particular sector.

Moreover, as we believe that affordable housing has already rallied quite a bit, therefore, it would be tough for the Manager to find it’s winning bets.

At last, as there is no tax advantage, therefore, we should advise staying away from this scheme in a market where you do have ample of opportunities.

Sources:

HDFC MF Website

Mint Newspaper articles

Hope you read our previous article on Bharat -22 ETF: https://goo.gl/WvjePr

Comments