Taking the Middle Road: Safety with high returns

- Time: 15 Minutes

- Oct 26, 2017

- 2 min read

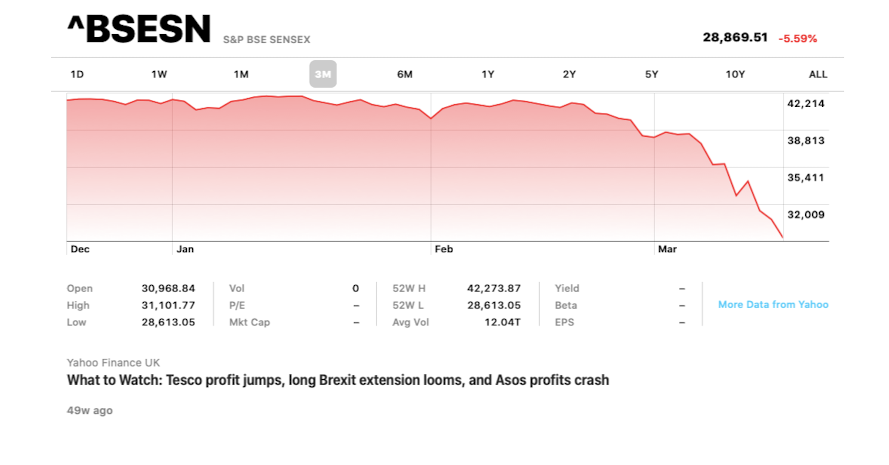

I am sure people who are following the stock markets these days would be worried about the steep valuations with the Sensex touching 32000 and they must be confused pertaining to the avenues where they can invest their money.

Most of us, the middle class, want to have the safety in terms of our principal, while enjoying the high returns of the equity market.

Is this possible, if yes, then how?

The strategy involves investing into a less risky product and using its returns to invest in an SIP (Systematic investment plan) of an equity mutual fund. This is most suited for people who are worried about the high valuation and would like to have some safety as well.

In this structure, investors put money into a non-convertible debenture(NCD) or an equity savings or arbitrage mutual fund.

Interest or dividend or capital appreciation from them are then invested every month into an equity mutual fund SIP. Using this strategy, the capital is protected, and the investor earns a higher post-tax return at the end of the tenure. Simply using the interest earned, there is a possibility of generating higher post-tax returns with lower risk.

For example, investors could put money into the NCD’s of SREI Equipment finance, which are available for subscription from July 17.Investors can opt for the monthly income option to earn 9.5% for a tenure of 10 years. So if an investor puts in 1.25 lakhs into this NCD, he earns a monthly interest of approximately 1000/-. This interest earned could be invested in the equity mutual fund SIP for 10 years and if it grows at 12%, the corpus could be worth Rs 2.3 lakhs. Adding the original principal and the growth in equity due to SIP, an investor could potentially get back Rs 3.55 lakh, which translates into a CAGR return of 11% per annum.

Risk-averse investors could use capital appreciation in select mutual funds to route money into equity SIPs.

Amidst falling interest rates on traditional savings products like fixed deposits, public provident fund(PPF), systematic investment plans(SIPs) have been gaining popularity amongst Indian investors as they help in rupee cost averaging and provide a disciplined approach to investing. The money inflow into such SIPs has jumped to Rs 4800 crore in June 2017 from 1200 crore in March 2014.

Comments