Mutual Fund is for everyone!

- Sanyam Jain & Prashant Agarwal

- Oct 31, 2017

- 4 min read

20 Minutes

In the 1st part you would have learnt about the Mutual Funds, how do they work, it’s advantages and what are the few of the Misconceptions associated with them.

This article builds upon it. Therefore, If you haven’t read that article then I will suggest you to first go through the same. Here’s the link: https://goo.gl/xYKt3e

Who should Invest in MF’s:

If you are a person who has a job which is very demanding and doesn’t leave you with any time to do any other thing, then Mutual Funds are for you.

You are a person who just wants to live a nice life rather than being worried about companies or read reports then, MF’s are for you.

You have never liked finance and you would like to focus on your other interests, then MF is for you.

In short, If you can research yourself about the company's, government bonds and other investment options than you can go ahead without MF’s, though it’s tough. Thus, a lot of people take the option of Mutual Funds.

Things to consider before buying MFs:

Risk = Returns: If you just buy a Mutual fund looking at it’s past performance of high returns, then you do need to understand that their will be periods of low returns as well.

They also require a one time research to know about the Fund Manager, their philosophy to growth and the risk associated with the particular Mutual Fund.

Another easy way is to pick top rated funds, as most of the rating agencies will be checking all the important aspects, which might not be possible for an individual. (Though, we do recommend doing your own research as well.)

Maintenance Charges: Similar to any other business, as they are managing your money to grow, they will charge a percentage as their service/Maintenance charges. It’s mostly in the bracket of 0.3% to 3%.

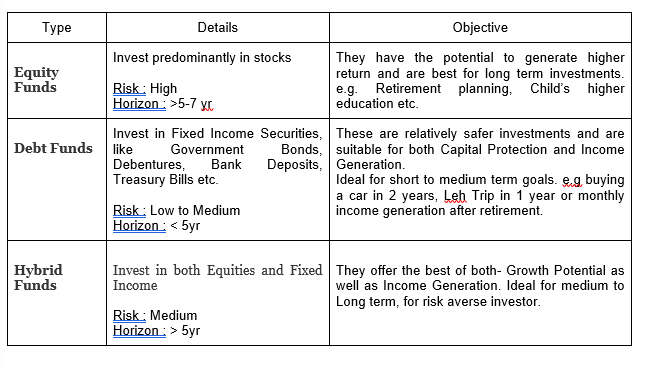

Types of Mutual Funds :

The word risk, turns off many new investors. Let’s understand it :

The graph shows last 4 year performance of randomly picked funds.

Debt liquid Fund grows at a constant rate, just like FD, not impacted by market at all. But, as we move up the ladder towards products with higher risk, the fluctuations increase.

How does Debt Funds gives better returns: Debt Funds also allocates your money in safe options like Bank deposits[1] [2] /bonds of private companies/Govt Bonds,but, a mutual Fund manager is able to scan all the options and their interest rate and invest in the one with the highest rate/growth. For eg currently HDFC is giving 3.5% for saving account while Airtel Bank and Kotak is giving 6%. So a MF can invest a part of his portfolio in a bank which is paying the highest interest. Moreover, with the big ticket size they are also able to leverage a better interest rate.

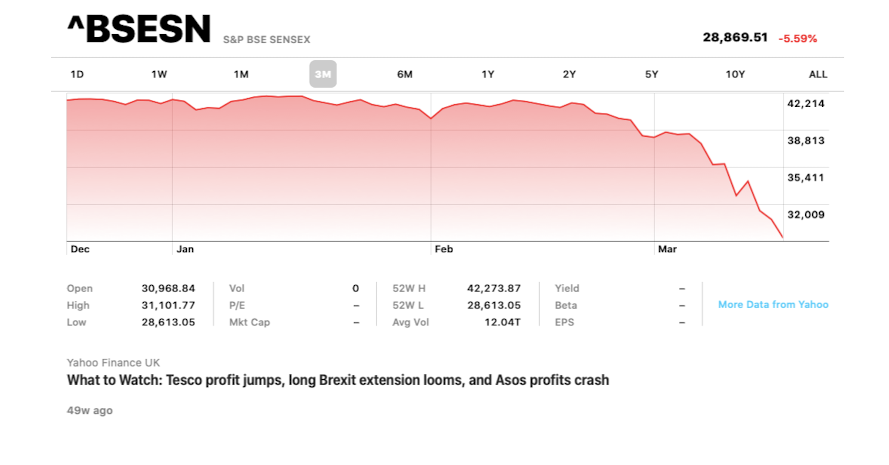

Equity mutual funds are for long run:

Between Jan’13 to Jul’13 - Equity MFs gave negative returns. This is difficult to digest for the usual Indian investor, who is used to slow but constant growth in FD. However, when we look from Jan 13 to July 17, equity returns were far above than the Debt ones. Therefore, we suggest you invest in equity Mutual funds only once you are able to commit for 5 years.

Remember: Higher the investment period, lesser the risk. Market fluctuations don’t really matter in the long term. {Based on historical Data}

Few other recommendations -

Lumpsum investment is fine with Debt MF, considering less volatility(fluctuations).

Whereas, in Equity there are fluctuations. So, Ideal way is to invest via Systematic Investment Plan(SIP) - investing fixed amount at a regular interval (monthly, weekly etc). This will average out the cost and risk.

To move the lump sum from debt to equity, one can go via a Systematic Withdrawal Plan(SWP) - moving fixed amount from one fund to another at a regular interval (monthly, weekly etc)

Things to keep in mind while getting into MF:

Direct Vs Regular MF’s

Growth Vs Dividend MF’s

Growth funds utilizes the power of compounding by reinvesting the profits, whereas Dividend funds distributes the profits. Growth option is more suitable for building wealth over long term and dividend option is more suitable for those who requires a regular flow of money.

Therefore, if you have a good paying job and are below 45 - Go for Growth Funds else go for dividend funds.

Direct Fund has less expense ratio(Charge in percent that Fund manager deducts to manage the fund), hence higher returns

Regular fund includes the extra cost of broker agent service. (Could be even 1% of the invested amount)

These days, it’s very easy to invest online & there is no need to go via broker or a Demat account. Invest in Direct fund, directly at the Fund House website or via MFUIndia.com which is a common portal and has all direct plans at no extra cost.

Selecting a fund - First choose the appropriate fund type based on your goal and then pick any top rated fund in that category. Refer to “valueresearchonline.com or moneycontrol.com” for ratings & performance.

Various Types of MF’s categories available in the Market.

Comments