Why the wealthiest pay the least taxes?

- Prashant Agarwal

- Jul 31, 2017

- 5 min read

Every coin has two sides ‘heads’ and ‘tails’. However, when it comes to people, there are multiple types of people and they are also treated differently by people according to the category they belong, though; the interesting bit is that they are also taxed accordingly in the system (some more and some less) and in fact the wealthiest pays the least …

Do you know why??

In this article we will explore where do you fall, why this disparity exist and will look forward to hear from you whether you feel it’s justified or not?

For example: If there is a huge supply of cotton but sugarcane is rare in a country.

Then for sure, the cotton prices are likely to be low & sugarcane will be expensive in this place. I am sure you will be with me till here, will request you to keep this thought at the back of your mind while going through this article.

Now, let’s look at any country’s economy – who do you think impacts it the most?

If your answer is 'Entrepreneur' then you are correct, as they are the ones who create employment and bring wealth to the system and thus providing the necessary amount to improve the facilities for everyone.

However, would any business run without money? So, for entrepreneurship to thrive, we need people who have the wealth and who are putting it to use in the form of investment (it may sound unfair that I am saying that the wealthy people are the important people, but for a second do try to think rationally). They are the ones who are oiling the machines to keep them running smoothly, they are the ones who would had provided the money for Reliance to grow to what it is today and similarly for Infosys, Tata’s and many others.

So, let’s see these different kinds of people (according to their professions) in the system and how much they are taxed (do see where you fall and do you want to move to some other category.)

1. Employee or service-class individual: This is a person who goes every day to an office to work and then comes back to his house. The Government feels that they are important but they consume the resources in terms of their dependence on someone else for job. There is always a need to create jobs for these people and they are the most abundant and thus they have to pay the maximum taxes( which they don’t say yet it happens, you will understand after reading this article) on their salary.

Therefore, they are taxed according to the tax bracket with no incentive and in most of the organisations, employer pays the salary only after deducting the taxes.

2. Freelancers or Consultant: This is a category, which runs it’s own business i.e. while they mostly don’t recruit others(or few in no’s) but they are their own enterprise.

They have to keep a lookout for the Jobs and don’t depend on a single organization. Therefore, the government gives them an incentive i.e. Whatever expenses they do in finding their next client i.e. Transport, meeting cost etc they can put that in expenditure and no taxes will be levied on it till the time they are justifiable. In this way they are able to save around 30% of their salary in form of expenditure.

3. Businessman: Now they are the people who are not just creating job opportunities for themselves for many others in the system and as this is an important job for an economy,they get huge benefit for doing this from the government i.e. They can show all their expense required to expand the company as company expenses and it will be deducted from the profit of the company.

a. So, if a CEO is going to Goa for a meeting and he plans to stay there for 3 extra days –They can show that meeting went for 4 days and put the complete expenditure in company’s name.

b. I do know one CEO who bought a Rolls Royce Phantom in the company name as he felt that he has to treat his clients better and they deserve a Phantom treatment.

Some people may call it unethical though you need to see their perspective, maybe - Rolls Royce do help this CEO to get new clients

4. Investors: However, this is one category, which is above all as they put money in the system for the machinery to run. So, if you see they are the one’s who invest in good ideas and make great businesses which in turn recruit freelancers and employees for their Job. It’s bit complicated to understand, yet this is the most basic way to understand it.

Though just to be fair, the government has created two segments in this.

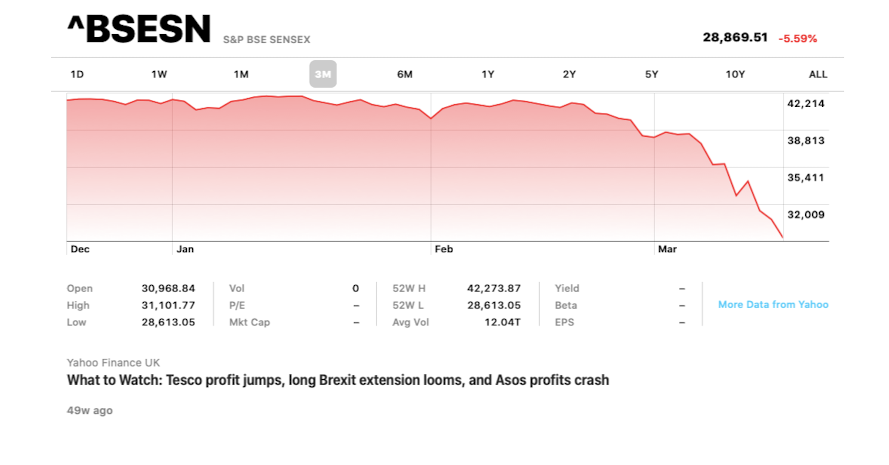

a. Short term investors: These are those who puts the money for a period of less than a year i.e. they put their money but at the slight hint of profit or loss they take their money out. As no industry can put their money to the best use, therefore these people are taxed at the same rate in which their income falls. So if someone makes more than 10 LPA then they will be taxed at flat 30%.

b. Long-term Investors: This is my favorite category and also helps the economy grow the most i.e. If you are willing to put your money and extend it to more than a year than all your gains are tax-free including the dividend. So an investor just doesn’t have to think about the taxes at all.

Note: An investor also needs to pay the Transaction fees and government charges while buying and selling the shares.

And the best part of ‘Investors’ is that anyone can become an investor with an amount as small as 10,000/-.

Will you like to become one!

Note: Becoming an investor through the stock market do looks lucrative and easy, but it’s a process similar to becoming a ‘Masters in Physics’ so you need to start with Newton’s 3 laws and then keep delving into it to become an expert or a good investor in this case.

I hope this gives you a clarity pertaining why investing is important and why I promote the long-term investing instead of short term investing.

Hope to see you helping the economy and also save some taxes along the way.

P.S. Do you agree that investors are important for any economy? Please do share your opinion in the comments.

If you like the article, don't forget to share it with your friends using the share button below.

Comments