Different stairs in Investing

- Prashant Agarwal

- Jul 19, 2017

- 4 min read

“Thanks for the session. I researched a bit now. Can you tell me, how I can double the money in the next 3 years?” This is the most common type of query I receive after conducting sessions.

I do understand that you would like to invest your money and you do want to see it grow fast, very fast… Consider this analogy - we can buy a fast bike but then we should also be ready to maneuver it during sharp turns and also understand the risk which comes along with high speed.

It’s quite similar with investing - while we do have safer options, which are easy to control; they don’t offer very attractive returns.Then on the other hand we have options which provide very high returns (doubling your money sometimes in six months) though they are risky in nature.

Remember this simple rule: Higher Returns = Higher Risk

The only way you can reduce the risk while still enjoying higher returns is by gaining experience of investing in the market.

Our advice to you is to consider this as a step by step process. You can assess the progress after every six months based on your understanding and the appetite for the higher risks.

The Ladder of Investing

While there can be other instruments, these are the broad categories. While health and term insurance don’t don’t strictly fall under investment, we feel it’s very important when it comes to investing in yourself.

Novice Investors:

You will identify with this if you have never invested or saved consistently over a period of at least 1 year.

If that’s you, I would suggest that you start with FD or RD and first try to create a discipline around keeping aside a part of your money in the form of FD or RD and no matter what, you don’t break your investment till the time period completes.

FD’s: This stands for Fixed Deposits i.e. If you have a lot of money lying in your bank and you can invest all that money in one go then FD is the product for you.

RD’s: This stands for Recurring Deposits i.e. If you have zero savings, in that case, you can go for RD. You can set a schedule action whereby every month on a specified date, a nominated amount will get deducted and can get transferred into your RD.

It’s very easy to setup – you can just go to visit the bank account online, and look for FD or RD tab there.

Health Insurance and Term Insurance:

Buy both the insurances for yourself and your family in case you haven’t got one.

Note: We recommend Term Insurance rather than ULIP or endowment.

Intermediate Level: Corporate Bonds

This is something which falls between the FD’s and the Mutual Funds as in these, you put your money in the FD’s of specific companies i.e. Shriram Transport, HDFC etc. These instruments are rated by the rating agencies like CRISIL. Don’t go for something which is rated below AA+ Category, which is considered quite safe.

They are offer you returns most of the time 1 or 2% above the Bank FD’s rate and also the guarantee that every year your money will surely grow.

Advanced Level: Mutual Funds or ETF

Congrats, if you are moving up the ladder from the Intermediate category or if you previously have saved for a year and you now want to invest in Mutual Fund or ETF.

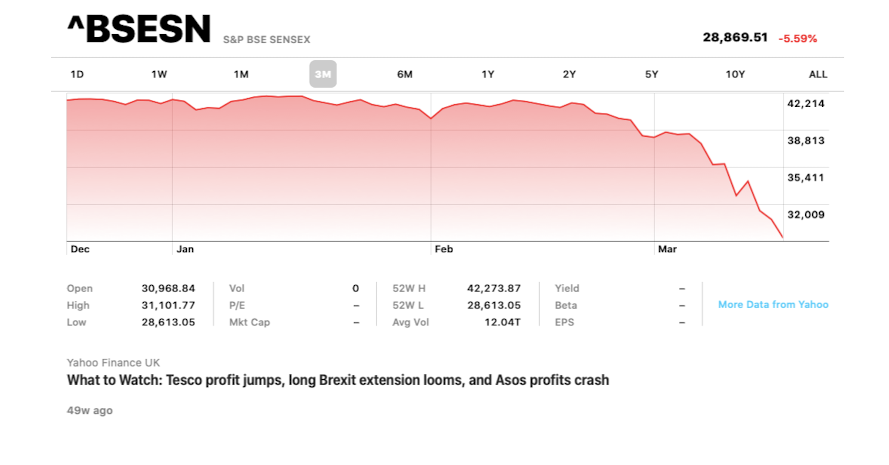

Mutual Funds look more attractive as most of the times they tend to give higher returns than index funds, basically due to their sheer nature of someone being in charge of making a right combination out of a bucket (Sensex or NIFTY), hence earning the higher interest.

But keep in mind that you do need to review the performance of your mutual Fund Manager every six months.

On the other hand, Index Fund is a complete replica of the Index bucket, investing your money the ratio of bucket composition.

Note: As we all know equity has its own risk, same goes with Equity MFs. To minimize the risk, it is advisable to stay invested for minimum 5 years. Historically, this has mostly generated better returns than FDs and they are completely tax free.

There is another category of MF known as debt funds which are less known. Return and risk profile is similar to Corporate Bonds

ETF and Mutual funds need a bigger discussion- Do lookout for our next entry to understand them better.

Expert Level: Stocks

A lot of serious investors have burned their fingers at this level and only a few investors in the world can truly be called experts here.

This level requires a completely different level of skill set, as you are in the driver’s seat most of the time. Either you can take the speed to 100 km/hr or stop the car or bump it in the wall.

If you have decided to invest in stocks, then here’s the path you should follow:

First read this entry to understand the difference between gambling and investing in stocks.

Then start reading about Warren Buffett, Rakesh Jhunjhunwala, Ramesh Damani and few others (They are the great giants in stock investing)

Do learn about Fundamental Analysis and this article can show you some great places to learn about the same.

Comments