LIC: A policy which may break your trust anytime

- Prashant Agarwal

- Jul 18, 2018

- 2 min read

LIC from the time immemorial has been the safety net for most of the Indians. In Fact, when I started working, my father told me “LIC policy le lena” - everyone considered it to be synonymous with safety and trust. However, I have realized that it’s the farthest from the truth.

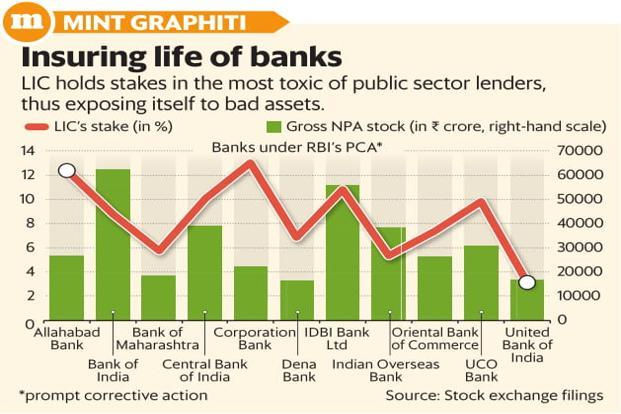

Recently, LIC came in news for trying to buy a 51% stake in IDBI Bank, an asset which nobody wants to touch. With stressed assets of Rs 55,588.26 Crore and bad loans a huge of 28% of the total loan book, IDBI is probably the worst of the bad banks of India.

Any guesses where this money is going to come from? From the more than 25 crore policyholders of Life Insurance Corporation of India(LIC). LIC will use up to Rs 13,000 crore of policy holder money to buy this 51% stake in IDBI.

Some analyst will tell you that LIC is an entity worth Rs 23 trillion and Rs 13000 is just 0.57% of that. Even if the entire money was to vaporize, there is little risk to policyholder money from this investment.

However, this is not an one off investment by LIC is a degrading asset if you see the other investment by LIC than we realize that LIC has always been asked to bail out the government whenever any asset turns toxic. Look at the picture below.

Yes, I understand that 13000 crore is a small part of the entire portfolio of LIC and also they plan to sell it in 6-7 years once the bank starts performing and they are able to make the profit out of it. However, wouldn’t it hurt the bonuses of the ordinary policy holder this year and the year they write off Rs 13000/- Crore if this transaction doesn’t work out? The clear answer is yes and shouldn't the objective of LIC be to maximize the gain for this policy holders?

I am definitely not sure for whose ‘Profit maximizing’ lies at the heart of LIC i.e. Is it the ordinary policy holder or the government, therefore recently I closed off my policy with LIC while I just got 30% of the amount invested by me yet I feel better as it’s good to sit with less cash than to sit with a ticking bomb.

Infact, If no one seriously objected to this transaction than it won’t be surprising if the financial institution(LIC) is forced to come to rescue of the government and pick up a stake in the beleaguered Airline( Air India) as well.

Note: At no point,I am suggesting to close your policy with the LIC - In Fact, you may be required to consult your financial advisor for the same as you should take your decision based on various parameters i.e. What policy you are holding with LIC, what it’s term and whether it’s better to retain or go in different directions.

Next Article: Next week, we would be writing about a detailed comparision between LIC and other private Insurance players and how they have performed over the years?

Want to know more about LIC and the LIC-IDBI deal :

https://economictimes.indiatimes.com/markets/expert-view/entire-idbi-lic-transaction-is-going-to-remain-under-a-cloud-of-suspicion-ananth-narayan/articleshow/64842537.cms

https://www.livemint.com/Money/JVLN7yCjDjsTEtBecXJRkK/A-little-bit-of-IDBI-Bank-in-my-LIC-policy.html

https://economictimes.indiatimes.com/markets/expert-view/idbi-bank-lic-deal-would-be-another-case-of-moving-money-from-one-pocket-to-another-amit-tandon-iias/articleshow/64733927.cms

https://www.livemint.com/Money/ZkqkG3Vt3sS0CtNhaTjmjK/Who-needs-a-bad-bank-We-have-LIC.html

Comments